What Happens After You Buy Crypto for the First Time?

You’ve done it. You’ve created an exchange account, connected your bank, and clicked that buy button. Your first cryptocurrency purchase is complete, and now you’re staring at your screen wondering what happens next. Do you just leave it there? Should you be doing something? What if you made a mistake?

That moment right after your first crypto purchase can feel both exciting and nerve wracking. You’ve entered a new world, and unlike buying stocks or putting money in a savings account, cryptocurrency can feel unfamiliar and slightly intimidating.

The good news is that nothing dramatic happens immediately after you buy crypto. Your cryptocurrency simply sits in your account, and you have plenty of time to figure out your next steps. But there are some important things you should know and consider in those first hours, days, and weeks after your purchase.

Your Crypto Appears in Your Account

The first thing that happens is actually pretty anticlimactic. Within seconds or minutes of completing your purchase, you’ll see the cryptocurrency appear in your exchange account. If you bought $100 worth of Bitcoin, you’ll see your Bitcoin balance reflecting however much Bitcoin $100 bought at the current price.

Unlike buying physical items where you wait for delivery, cryptocurrency transfers are nearly instant. The exchange debits your payment method and credits your account with the crypto. You now own it, and you can see your balance whenever you log into your exchange account.

You’ll also receive a confirmation email detailing your transaction. This includes information like what you bought, how much you paid, how much cryptocurrency you received, and any fees charged. Keep these emails for your records, especially for tax purposes later.

Your account dashboard will show your current balance, what you originally paid, and your current profit or loss based on price changes since your purchase. Don’t be surprised if this number changes constantly. That’s completely normal in the volatile crypto market.

The Price Starts Moving Immediately

Here’s something that surprises many first time buyers: the value of your investment will likely change significantly within minutes or hours of your purchase. Cryptocurrency prices move constantly, 24 hours a day, seven days a week.

You might check your account an hour after buying and see that your $100 investment is now worth $103. Or it might be worth $97. By the next day, it could be $110 or $90. These fluctuations are completely normal and don’t necessarily mean anything significant about your investment.

This constant movement can be psychologically challenging for new investors. When you see your investment drop 5% or 10% shortly after buying, your first instinct might be panic. Did you make a mistake? Should you sell before it drops further?

The answer is almost always to do nothing. Short term price movements are essentially random noise. What matters is the long term trend over months and years, not what happens in the first hours or days. Successful crypto investors learn to ignore these short term fluctuations and focus on their overall strategy.

Many new investors make the mistake of checking their balance constantly, sometimes dozens of times per day. This habit usually leads to unnecessary stress and poor decisions. Consider checking your investment weekly or even monthly instead of hourly or daily.

You Don’t Have to Do Anything Right Away

One of the most important things to understand is that you’re not required to take any immediate action after buying crypto. Your cryptocurrency will simply sit in your exchange account, safe and secure, until you decide what to do with it.

You don’t need to trade it, move it, or do anything technical. You can literally buy crypto and then not think about it for days, weeks, or months if you want. Many successful investors take exactly this approach, buying cryptocurrency and then holding it long term without constantly managing it.

This is actually one of the hardest lessons for new investors to learn. The crypto world can feel urgent, with prices changing constantly and people online talking about buying and selling. But the reality is that doing nothing is often the best strategy, especially for beginners.

Your crypto isn’t going anywhere. It will sit in your account collecting dust if you want it to, which is perfectly fine. There’s no clock ticking, no deadline approaching, and no requirement to be actively involved unless you choose to be.

Understanding Your Storage Options

While your crypto can stay on the exchange indefinitely, it’s worth understanding where it’s actually stored and what your options are.

When you buy crypto on an exchange, it stays in an account controlled by that exchange. The exchange is essentially holding your crypto for you, similar to how a bank holds your money. This is called keeping your crypto on the exchange or in a custodial account.

For beginners with smaller amounts, this arrangement is usually fine. Reputable exchanges have strong security measures, and keeping your crypto there means you can easily buy more or sell whenever you want. It’s convenient and straightforward.

However, exchanges can be hacked, face technical problems, or even go out of business. For this reason, many experienced crypto investors eventually move their holdings to a personal wallet. A wallet is software or a device that lets you control your crypto directly without the exchange as a middleman.

As a new investor, you don’t need to worry about wallets immediately. Wait until you’re comfortable with the basics and have a meaningful amount invested. When you’re ready to learn about wallets, you’ll have plenty of time to research and choose the right option for you.

You’ll Start Paying Attention to Crypto News

Something interesting happens after you buy cryptocurrency: you suddenly start noticing crypto news everywhere. Articles you previously scrolled past now catch your attention. Conversations about Bitcoin suddenly seem relevant. You find yourself checking price charts and reading about market trends.

This is natural and actually helpful. Having real money invested, even a small amount, makes you pay attention in ways that purely academic interest never could. You’ll learn much faster now that you have skin in the game.

However, be careful about where you get your information. The crypto space is full of hype, misinformation, and people trying to manipulate others for their own benefit. Stick to reputable news sources and be skeptical of anonymous accounts on social media promising guaranteed returns or insider information.

Join a few quality communities where you can learn from more experienced investors, but maintain a healthy skepticism. Not everyone giving advice has your best interests at heart, and not every enthusiastic post is based on solid reasoning.

Your Emotions Might Surprise You

Be prepared for an emotional experience over the coming days and weeks. Watching your investment fluctuate in value can trigger strong feelings, and you might be surprised by your own reactions.

When your investment increases in value, you’ll feel excited and vindicated. You might start thinking about buying more or fantasizing about what you’ll do when your gains multiply. This feeling of euphoria can lead to overconfidence and risky decisions.

When your investment decreases, you might feel anxious, regretful, or fearful. You might wonder if you should sell to prevent further losses, or you might compulsively check prices hoping they’ve recovered. This fear can lead to panic selling at exactly the wrong time.

These emotional swings are completely normal and happen to everyone, not just beginners. The key is recognizing these emotions for what they are and not letting them drive your decisions. The most successful investors develop emotional discipline, making decisions based on their strategy rather than their feelings in the moment.

If you find yourself losing sleep over your crypto investment or feeling genuinely stressed, it’s a sign you’ve invested too much. You should only invest money you can truly afford to lose, to the point where even a total loss wouldn’t significantly impact your life.

Considering Your Next Move

After the initial excitement settles, you’ll need to think about your strategy going forward. What are your actual plans for this investment?

Many beginners benefit from setting up regular, automatic purchases. Instead of trying to time the market or making random purchases when you feel like it, you invest a fixed amount on a fixed schedule. Maybe you buy $50 worth every Monday, or $200 on the first of every month. This approach, called dollar cost averaging, takes emotion out of the equation and builds your position over time.

Decide when and how you’ll add more money to your investment, if at all. You don’t have to buy more, but if you plan to, having a system prevents impulsive decisions during market excitement or fear.

Think about your selling strategy too. Under what conditions would you sell? Are you holding for years, or do you have a specific price target where you’ll take profits? Having a plan before you need it prevents emotional decisions later.

Many successful investors follow a simple strategy: buy regularly, hold long term, and ignore short term volatility. This boring approach actually tends to outperform more active trading for most people.

Tax Considerations to Remember

Here’s something many new crypto investors forget: buying cryptocurrency itself isn’t a taxable event in most places, but selling it is. When you eventually sell your crypto, you’ll likely owe taxes on any gains.

Keep good records of your purchases, including dates, amounts, and prices paid. Most exchanges provide transaction histories, but maintain your own records as backup. When tax time comes, you’ll need this information to accurately report your crypto activities.

If you’re in the United States, cryptocurrency is treated as property for tax purposes. This means selling it for a profit creates capital gains, just like selling stocks or real estate. The tax rate depends on how long you held the crypto and your income level.

You don’t need to become a tax expert immediately, but being aware that taxes exist and keeping good records from the start will save you headaches later.

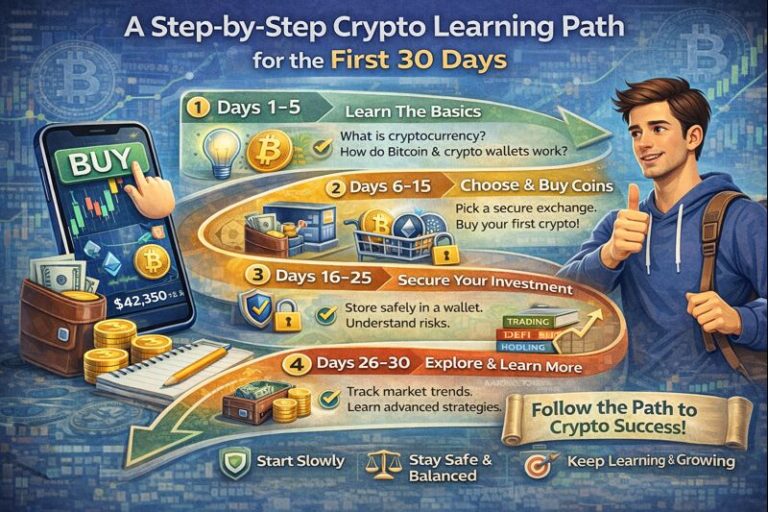

Building Knowledge Gradually

Your first crypto purchase is really just the beginning of a learning journey. Now that you’re invested, use that motivation to continue educating yourself about cryptocurrency, blockchain technology, and investing in general.

Read books about crypto investing. Follow reputable educational resources. Learn about the specific cryptocurrencies you own and why they have value. Understand the technology enough to make informed decisions, even if you don’t need to become a technical expert.

The more you learn, the more confident you’ll become in your investment decisions. You’ll stop reacting emotionally to every price movement and start thinking strategically about your crypto holdings.

The Bottom Line

After you buy crypto for the first time, it simply sits in your exchange account while its value fluctuates based on market movements. You don’t need to do anything immediately, and the best approach for most beginners is to leave it alone while continuing to learn.

You’ll likely experience emotional reactions to price changes, which is normal. The key is developing discipline and sticking to a long term strategy rather than reacting to short term volatility.

Your first purchase is an important milestone, but it’s just the first step. Focus on building knowledge, developing good habits like regular investing, and maintaining emotional control. These foundational practices will serve you far better than any attempt to actively trade or constantly manage your holdings.

Welcome to the world of cryptocurrency investing. Take your time, learn continuously, and remember that this is a marathon, not a sprint.