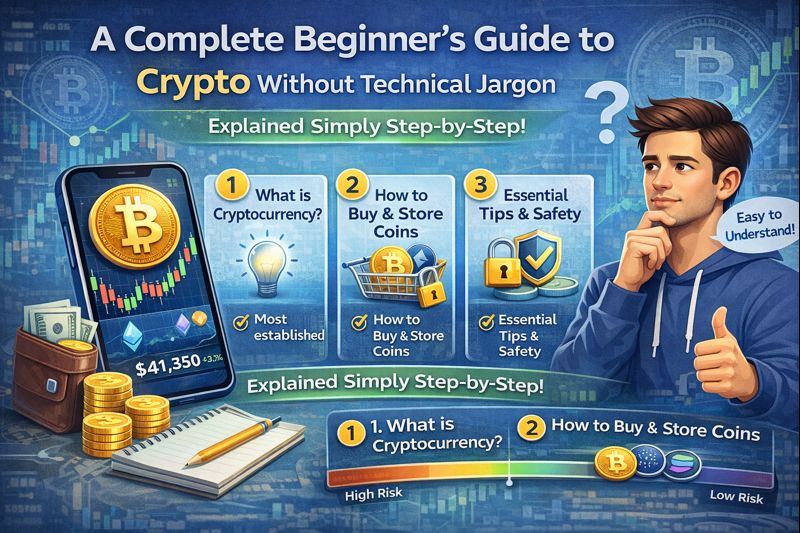

A Complete Beginner’s Guide to Crypto Without Technical Jargon

Let’s be honest: most cryptocurrency guides sound like they were written by robots for robots. They’re filled with terms like blockchain, decentralization, cryptographic hashing, and consensus mechanisms that leave regular people more confused than when they started.

If you’ve felt overwhelmed trying to understand crypto, you’re not alone. The good news is that you don’t need a computer science degree to get started with cryptocurrency. You can understand the basics and start investing without drowning in technical terminology.

Think of this as your friend explaining crypto over coffee, not a textbook trying to impress you with complicated words. By the end of this guide, you’ll understand what cryptocurrency actually is, why people care about it, and how to get started if you choose to invest.

What Is Cryptocurrency in Plain English?

At its core, cryptocurrency is digital money. That’s it. Just like you can send someone $20 through a payment app on your phone, you can send them cryptocurrency. The difference is in how it works behind the scenes.

Regular money, whether physical cash or the numbers in your bank account, is controlled by governments and banks. When you send money through your bank, the bank keeps track of the transaction and makes sure everything is legitimate. The bank is the middleman that makes it all work.

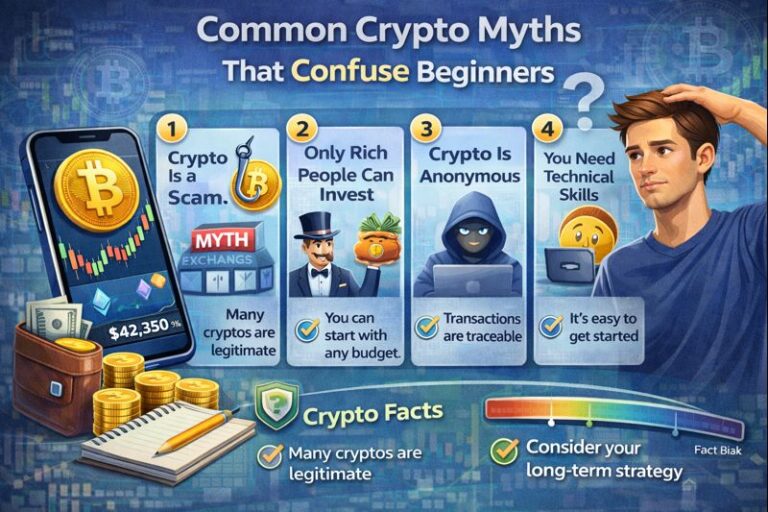

Cryptocurrency removes that middleman. Instead of a bank verifying and recording your transaction, a network of computers around the world does it together. No single company or government controls it. The transaction gets recorded in a permanent record that everyone can see but no one can change or fake.

Imagine a notebook that records every transaction ever made with a particular cryptocurrency. This notebook isn’t kept by one person or company. Instead, thousands of people have identical copies, and they all automatically update together. If someone tries to cheat by changing their copy, everyone else’s copies prove them wrong. That’s essentially how cryptocurrency works.

Why Do People Use Cryptocurrency?

You might be wondering why anyone would bother with cryptocurrency when regular money works fine. There are actually several reasons people find it appealing.

Some people like that no government or corporation controls it. If you’re worried about banks freezing accounts, governments printing too much money and causing inflation, or companies tracking your purchases, cryptocurrency offers an alternative. You control your own money directly without needing permission from anyone.

Others see it as an investment opportunity. Many cryptocurrencies have increased dramatically in value over time. People who bought Bitcoin years ago for a few dollars now have assets worth thousands or even tens of thousands per coin. Of course, prices can also fall dramatically, which is an important risk to understand.

Cryptocurrency can also make certain transactions easier and cheaper. Sending money internationally through traditional banks can take days and cost significant fees. Some cryptocurrencies can transfer money across the world in minutes for minimal cost.

Some people simply find the technology fascinating and want to be part of what they see as the future of money. They believe that just as the internet changed how we communicate, cryptocurrency will change how we handle finances.

The Main Cryptocurrencies You Should Know

There are thousands of different cryptocurrencies, but you only need to know about a few to get started.

Bitcoin is the original and most famous cryptocurrency. It was created in 2009 and is what most people think of when they hear the word crypto. Bitcoin is often compared to digital gold because there’s a limited supply and people view it as a store of value. Most people who get into crypto start with Bitcoin because it’s been around the longest and is the most established.

Ethereum is the second most popular cryptocurrency. While Bitcoin is mainly digital money, Ethereum is more like a digital platform where people can build applications. Think of Bitcoin as digital gold and Ethereum as digital infrastructure that powers various projects and services. Many other cryptocurrencies and projects are built on top of Ethereum.

Everything else gets lumped into a category often called altcoins, which just means alternative coins. Some of these serve specific purposes like faster transactions or more privacy. Many others are experimental or, frankly, not worth your time and money. As a beginner, you’re better off ignoring most altcoins until you really understand what you’re doing.

How to Actually Buy Cryptocurrency

Buying cryptocurrency is actually simpler than you might think. You don’t need special equipment or technical knowledge. Here’s the basic process.

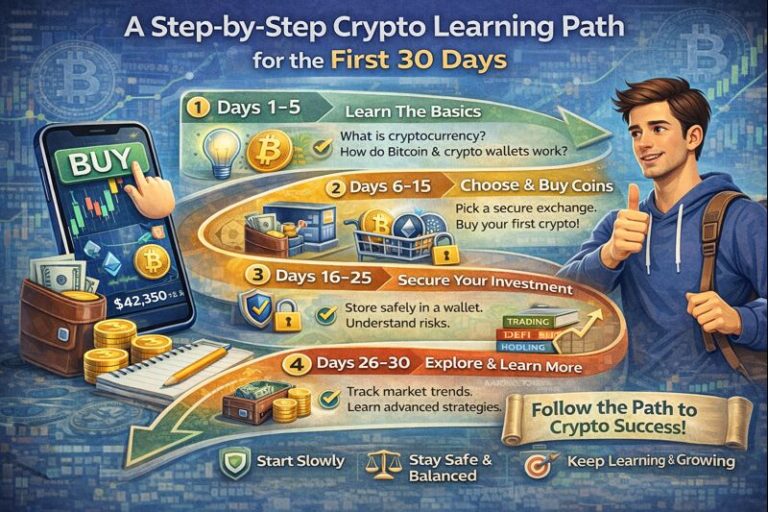

First, you sign up for a cryptocurrency exchange. These are websites or apps where you can buy and sell cryptocurrency using regular money. Popular exchanges include Coinbase, Kraken, and Gemini. Think of them like stock trading apps but for cryptocurrency instead of stocks.

Signing up is similar to opening any online account. You provide your email, create a password, and verify your identity by uploading a photo ID. This identity verification is required by law to prevent money laundering and fraud, so every legitimate exchange requires it.

Once your account is set up, you connect your bank account or debit card. This lets you transfer regular money into your exchange account. Some exchanges let you buy crypto directly with a card, though this often comes with higher fees.

With money in your account, you simply choose which cryptocurrency you want to buy and how much you want to spend. The exchange shows you how much cryptocurrency you’ll receive based on the current price. You confirm the purchase, and within seconds or minutes, you own cryptocurrency.

You don’t need to buy a whole Bitcoin or a whole unit of any cryptocurrency. You can buy fractions. If Bitcoin costs $50,000 and you want to invest $100, you’ll get 0.002 Bitcoin. It’s like buying a slice of pizza instead of the whole pie.

Where Your Cryptocurrency Lives

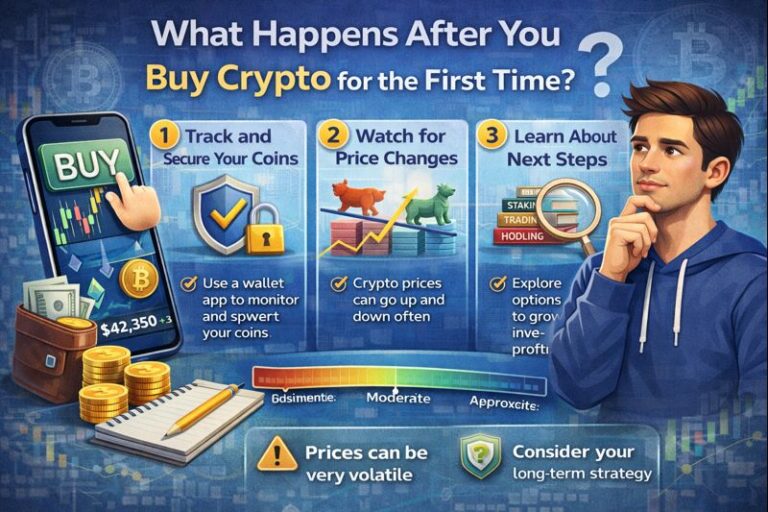

This part confuses a lot of beginners, so let’s make it simple. When you buy cryptocurrency on an exchange, it initially stays on that exchange in your account. The exchange is holding it for you, similar to how a bank holds your money.

Many beginners keep their crypto on the exchange, and that’s fine when you’re starting out with small amounts. It’s convenient because you can easily buy more or sell whenever you want.

However, exchanges can be hacked, go out of business, or have technical problems. For this reason, people with larger amounts of cryptocurrency often move it to a personal wallet. A cryptocurrency wallet is basically a secure place where you control your crypto directly, without the exchange as a middleman.

There are different types of wallets, from apps on your phone to physical devices that look like USB drives. As a beginner with a small investment, keeping your crypto on a reputable exchange is usually fine. You can learn about wallets later if you decide to invest more seriously.

Understanding the Risks

Cryptocurrency can be a good investment, but it’s also risky. You need to understand what you’re getting into before putting your money in.

The biggest risk is volatility, which just means that prices swing wildly. Your investment might be worth $1,000 today, $700 next week, and $1,200 the week after that. These dramatic price changes are normal in crypto. If seeing your investment drop 30% or 40% would stress you out or hurt you financially, you either shouldn’t invest in crypto or should invest only a very small amount you can afford to lose.

Unlike money in a bank account, cryptocurrency isn’t insured by the government. If you lose access to your crypto or it gets stolen, there’s usually no way to get it back. This makes security extremely important.

Scams are also common in the crypto world. People create fake cryptocurrencies, run fraudulent exchanges, or promise guaranteed returns to trick people out of their money. If something sounds too good to be true, it almost certainly is. Stick with well known cryptocurrencies and established exchanges.

There’s also regulatory uncertainty. Governments are still figuring out how to handle cryptocurrency, and new laws could affect its value or how easily you can use it.

Starting Small and Learning

If you decide to invest in cryptocurrency, start small. Don’t invest money you need for bills, emergencies, or important goals. Think of your first crypto purchase as paying for an education. Invest a small amount, maybe $50 to $200, and use it to learn how everything works.

Watch how the price moves. Pay attention to what news and events affect cryptocurrency prices. Learn how to check your balance, how to buy more, and how to sell if you want to. Get comfortable with the whole process before investing larger amounts.

Many people make the mistake of investing too much too quickly because they’re excited or afraid of missing out on gains. Then when prices drop, they panic and sell at a loss. Starting small prevents this emotional rollercoaster and gives you time to develop a rational, long term approach.

Simple Strategies for Success

Successful crypto investors typically follow a few basic strategies that beginners can easily understand and implement.

First, most successful investors think long term. They buy cryptocurrency and hold it for years, not days or weeks. Short term trading requires constant attention, deep knowledge, and usually results in losses for beginners. Buying and holding is simpler and historically more successful.

Second, they invest consistently over time rather than putting all their money in at once. This approach, buying a little bit regularly like $50 every week or $200 every month, helps smooth out price fluctuations. Sometimes you’ll buy when prices are high, sometimes when they’re low, and it all averages out.

Third, they don’t panic when prices drop. Cryptocurrency prices fall sometimes. That’s normal. If you invested money you can afford to lose and you’re thinking long term, temporary price drops shouldn’t cause you to make emotional decisions.

Finally, they keep learning. The crypto world changes quickly. Staying informed through reliable news sources helps you make better decisions and avoid scams.

Is Cryptocurrency Right for You?

Cryptocurrency isn’t for everyone, and that’s okay. It makes sense for people who are comfortable with technology, can handle significant price swings without panicking, have money they can afford to invest without hurting their financial security, and are interested in learning about new financial technology.

It’s not a good fit if you need guaranteed returns, can’t afford to lose your investment, want something completely stable and predictable, or simply aren’t interested enough to learn the basics.

There’s no shame in deciding cryptocurrency isn’t for you. There are plenty of other ways to invest and build wealth. But if the idea intrigues you, starting with a small, manageable investment while continuing to learn can be a reasonable way to explore this new frontier of finance.

The Bottom Line

Cryptocurrency is digital money that works without banks or governments controlling it. Bitcoin is the most established, Ethereum is second, and everything else is more experimental. You can buy it through exchanges using regular money, and while it offers potential rewards, it also comes with real risks.

Start small, learn as you go, and never invest more than you can afford to lose. Approach it as a long term commitment rather than a get rich quick scheme, and keep learning along the way.

You don’t need to understand every technical detail to get started. With the basics covered in this guide, you know enough to make an informed decision about whether cryptocurrency is right for you, and how to take your first steps if you decide to explore further.