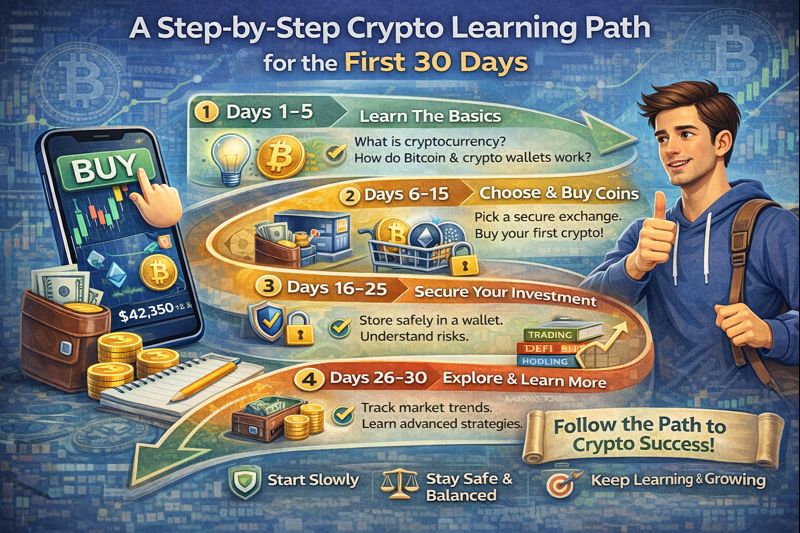

A Step-by-Step Crypto Learning Path for the First 30 Days

Starting your cryptocurrency journey can feel overwhelming. There’s so much to learn, so many conflicting opinions, and the fear of making expensive mistakes looms large. You might be wondering where to even begin or what order to learn things in to avoid confusion.

The good news is that you don’t need to learn everything at once. In fact, trying to absorb too much information too quickly usually leads to confusion and poor decisions. What you need is a structured path that builds your knowledge gradually, allowing each concept to sink in before moving to the next level.

This 30 day learning plan will take you from complete beginner to someone who understands crypto fundamentals and can make informed investment decisions. You don’t need to spend hours each day. Just 20 to 30 minutes of focused learning will get you there. By the end of this month, you’ll have the foundation you need to invest confidently and continue learning on your own.

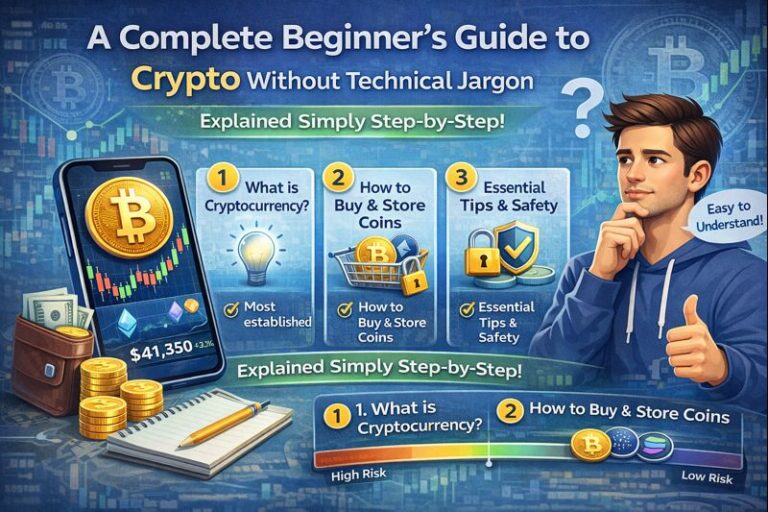

Days 1 to 3: Understanding the Basics

Your first three days should focus on understanding what cryptocurrency actually is at a fundamental level. Don’t worry about investment strategies or which coins to buy yet. Just wrap your head around the core concepts.

Start by learning what cryptocurrency is and why it exists. Understand that it’s digital money that works without banks or governments controlling it. Learn the basic story of Bitcoin, the first cryptocurrency created in 2009, and why someone felt the need to invent it in the first place.

Research what problems cryptocurrency aims to solve. This includes things like high fees for international money transfers, lack of financial access for people without bank accounts, concerns about inflation and government control of money, and the desire for financial privacy.

You should also understand what blockchain is in simple terms. Think of it as a digital ledger or record book that many people maintain copies of simultaneously. When someone makes a transaction, it gets recorded in this ledger, and because everyone has a copy, no one can cheat or change the records.

By day three, you should be able to explain to a friend in plain English what cryptocurrency is and why people think it matters. If you can’t do that yet, spend another day or two on these basics before moving forward.

Days 4 to 7: Learning About Major Cryptocurrencies

Now that you understand what crypto is generally, spend the next few days learning about the major cryptocurrencies that actually matter. There are thousands of cryptocurrencies, but only a handful are significant enough for beginners to focus on.

Dedicate day four to learning specifically about Bitcoin. Understand why it’s called digital gold, what gives it value, why its supply is limited to 21 million coins, and why it’s considered the most established and least risky cryptocurrency. Learn about its price history and how it has recovered from multiple crashes over the years.

On day five, focus on Ethereum. Learn how it differs from Bitcoin by enabling smart contracts and decentralized applications. Understand that Ethereum is more like a platform or operating system where developers can build things, not just a currency. This fundamental difference between Bitcoin and Ethereum is important to grasp.

Days six and seven can be spent learning about the broader cryptocurrency landscape. Research what altcoins are and why thousands of them exist. Learn about different categories like stablecoins that maintain steady prices, privacy coins that focus on anonymous transactions, and coins designed for specific industries or purposes.

The goal isn’t to become an expert on every cryptocurrency but to understand the major players and the general landscape. By the end of this week, you should know the difference between Bitcoin and Ethereum and understand that not all cryptocurrencies serve the same purpose.

Days 8 to 10: Understanding How to Actually Buy Crypto

Knowledge is useless if you don’t know how to act on it. These three days focus on the practical steps of actually buying cryptocurrency when you’re ready.

Start by researching cryptocurrency exchanges. These are the platforms where you buy and sell crypto. Learn about major exchanges like Coinbase, Kraken, Binance, and Gemini. Understand that exchanges are essentially marketplaces connecting buyers and sellers, and they charge fees for this service.

Research what the sign up process looks like. You’ll need to provide identification to verify your identity, which is required by law to prevent money laundering. Understand that this is normal and every legitimate exchange requires it. Learn about connecting your bank account or debit card to fund your purchases.

Spend time understanding fees. Different exchanges charge different amounts, and these fees can significantly impact your returns over time. Learn about trading fees, withdrawal fees, and the difference between maker and taker fees if the exchange uses that model.

Also research the security features exchanges offer, like two factor authentication. Understand why security matters and what basic precautions you should take to protect your account.

By day ten, you should feel comfortable with the mechanics of how buying crypto actually works, even if you haven’t bought any yet. You should know which exchanges are reputable and how the process would unfold if you decided to make a purchase.

Days 11 to 14: Learning Investment Strategies

Now that you know what crypto is and how to buy it, spend these days learning about smart investment approaches. This is where many beginners make mistakes, so take this section seriously.

Learn about dollar cost averaging, which means investing a fixed amount at regular intervals regardless of price. Understand why this strategy helps reduce the risk of buying at a market peak and how it removes emotion from your investment decisions.

Research the concept of only investing what you can afford to lose. Understand why this matters more in crypto than in traditional investments due to extreme volatility. Calculate what amount would be meaningful enough to care about but small enough that losing it wouldn’t hurt your financial situation.

Spend a day learning about diversification within crypto. Should you put everything in Bitcoin, or should you split your investment between Bitcoin and Ethereum or other coins? Understand the trade offs between simplicity and diversification for someone just starting out.

Also learn about time horizons and why most successful crypto investors think long term. Research stories of people who panic sold during crashes and missed subsequent recoveries. Understand how short term volatility differs from long term trends.

By day fourteen, you should have a clear idea of how you would approach crypto investing if you decided to start. You should know how much you might invest, how frequently, and in which cryptocurrencies.

Days 15 to 18: Understanding Risks and Security

Before you invest, you absolutely must understand the risks you’re taking and how to protect yourself. These days focus on the darker side of crypto that you need to be aware of.

Learn about volatility and what it really means in practice. Look at historical price charts and see how Bitcoin has dropped 50%, 70%, or even more during bear markets. Understand that what you see going up can also come down dramatically and quickly.

Research common crypto scams. Learn about fake exchanges, Ponzi schemes promising guaranteed returns, pump and dump schemes, phishing attempts to steal your login credentials, and fake giveaways from impersonators of famous people. Understanding how scams work protects you from falling victim to them.

Spend time learning about proper security practices. This includes using strong, unique passwords, enabling two factor authentication, never sharing your login information, being careful about which websites you visit, and not clicking suspicious links in emails or messages.

Also understand the risks of exchanges themselves. While major exchanges are generally safe, they can be hacked, face technical problems, or in rare cases go bankrupt. Learn why some people eventually move crypto to personal wallets for additional security, though this isn’t necessary immediately for small amounts.

By day eighteen, you should have a realistic understanding of what can go wrong and how to protect yourself. This knowledge prevents costly mistakes and helps you invest with appropriate caution.

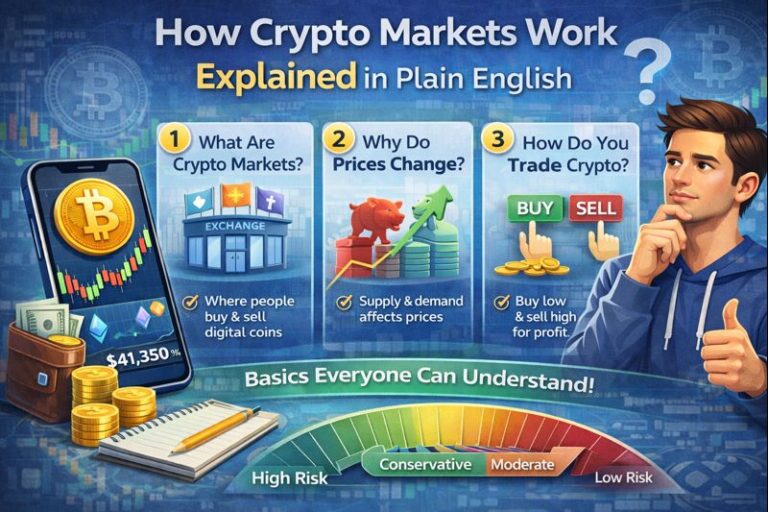

Days 19 to 22: Exploring Market Dynamics

These days focus on understanding how crypto markets work and what moves prices. This knowledge helps you interpret what you see happening and avoid emotional reactions.

Learn about supply and demand basics. Understand that prices rise when more people want to buy than sell, and fall when more people want to sell than buy. Simple as it sounds, this fundamental concept explains all price movements.

Research what factors influence crypto prices. This includes news and announcements, actions by major investors or institutions, technology updates and developments, social media and community sentiment, and broader economic conditions affecting all investments.

Spend time understanding market cycles. Learn about bull markets when prices are generally rising and optimism is high, bear markets when prices are falling and pessimism dominates, and consolidation periods when prices move sideways. Understand that these cycles are normal and repeat over time.

Also learn about market sentiment and psychology. Understand concepts like fear of missing out that drives buying during rallies, and fear, uncertainty, and doubt that triggers panic selling during declines. Recognizing these emotions in yourself and others helps you make rational decisions.

By day twenty two, you should understand why prices move and feel less confused by the market’s apparent randomness. You’ll recognize patterns and emotional cycles that seem mysterious to most beginners.

Days 23 to 25: Taxation and Legal Considerations

This might not be the most exciting part of learning about crypto, but it’s essential to understand the legal and tax implications before you invest.

Research how cryptocurrency is taxed in your country. In many places, crypto is treated as property, meaning selling it for a profit creates taxable capital gains. Understand that buying crypto isn’t taxed, but selling it, trading it for other crypto, or using it to buy things generally creates tax obligations.

Learn about record keeping requirements. Understand that you need to track when you bought crypto, how much you paid, when you sold, and how much you received. Most exchanges provide transaction histories, but keeping your own records is wise.

Research whether there are any legal restrictions on cryptocurrency in your location. Most places allow it, but some countries have banned or heavily restricted crypto. Make sure you’re operating within the law.

Also learn about reporting requirements. Some jurisdictions require you to report crypto holdings above certain amounts or transactions exceeding specific values. Understanding these rules prevents legal problems down the road.

You don’t need to become a tax expert, but you should know enough to invest legally and avoid surprises when tax time arrives.

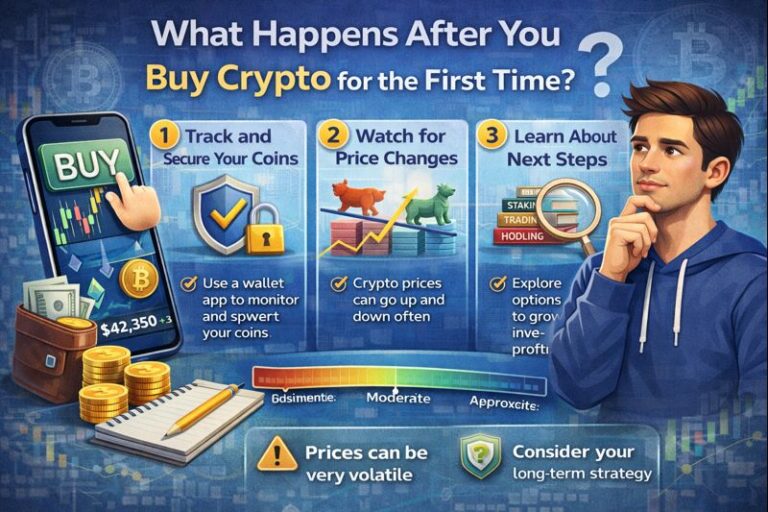

Days 26 to 28: Making Your First Small Investment

If you’ve followed this learning path, you now have enough knowledge to make an informed first investment. These days are about taking action with a small amount to get hands on experience.

Choose a reputable exchange and create an account. Go through the verification process, connect your bank account, and familiarize yourself with the platform’s interface. Take your time and don’t rush this process.

Decide on a small amount to invest for learning purposes. This should be money you can truly afford to lose, perhaps $50 to $200. The goal isn’t to get rich but to experience what crypto investing feels like with real money at stake.

Make your first purchase. Start with Bitcoin or Ethereum since they’re the most established. Go through the buying process, confirm the transaction, and watch as your cryptocurrency appears in your account. Congratulations, you’re now a crypto investor.

After your purchase, resist the urge to constantly check the price. Set a schedule for checking your investment, perhaps once per day or even once per week. Use this time to observe your own emotional reactions to price movements and practice maintaining discipline.

Days 29 to 30: Planning Your Ongoing Strategy

Your final two days focus on establishing a sustainable long term approach to crypto investing and learning.

Create a plan for regular investments if you decide to continue. Decide how much you’ll invest and how frequently. Set up automatic purchases if your exchange offers this feature, or create calendar reminders for manual purchases.

Identify trusted sources for ongoing education. Find a few quality blogs, YouTube channels, or news sites that provide balanced, educational content about crypto. Avoid sources that seem focused on hype or promoting specific coins for profit.

Join one or two quality online communities where you can ask questions and learn from experienced investors. Reddit has several crypto communities, though be selective and skeptical of advice. Remember that not everyone online has good intentions or knowledge.

Set a schedule for reviewing your investment and continuing your education. Maybe you check your portfolio weekly and spend 30 minutes each weekend reading about crypto. Consistent, ongoing learning keeps you informed without becoming obsessive.

Finally, write down your investment rules and strategy. Document why you’re investing, what your goals are, under what conditions you would sell, and what principles guide your decisions. Having this written down prevents emotional choices during volatile periods.

The Bottom Line

These 30 days provide a solid foundation for understanding cryptocurrency and making informed investment decisions. You’ve learned the basics, explored major cryptocurrencies, understood how to buy crypto, learned investment strategies, grasped the risks, understood market dynamics, learned about taxes, made a first small investment, and planned your ongoing approach.

The learning doesn’t stop after 30 days. Crypto is a rapidly evolving space, and staying informed requires ongoing attention. But you now have the fundamental knowledge to participate safely and continue learning independently.

Remember that this is a marathon, not a sprint. Take your time, invest conservatively, and focus on long term wealth building rather than quick profits. The knowledge you’ve gained over this month positions you far ahead of most people who jump into crypto impulsively without proper preparation.

Your crypto journey is just beginning, but you’re starting it the right way with knowledge, caution, and a solid plan. Keep learning, stay disciplined, and make decisions based on research rather than emotion or hype.