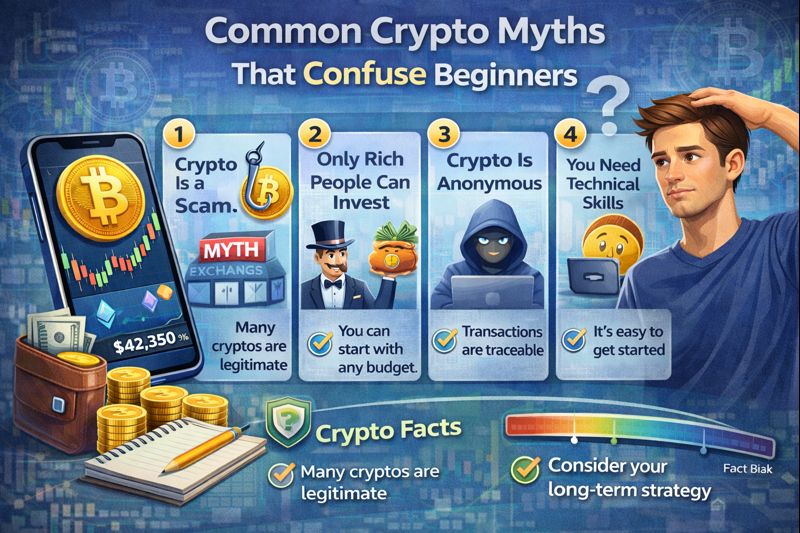

Common Crypto Myths That Confuse Beginners

If you’ve spent any time learning about cryptocurrency, you’ve probably encountered conflicting information that left you more confused than when you started. One article says crypto is the future of money. Another says it’s a scam. Someone tells you that you need to buy whole Bitcoins. Someone else says you missed your chance to profit because you’re too late.

The crypto space is filled with myths, misconceptions, and outdated information that can mislead beginners and prevent them from making smart decisions. Some of these myths come from people who don’t understand crypto well enough to explain it accurately. Others come from those with agendas, whether they’re trying to pump up investments they already own or discourage competition.

Understanding what’s actually true versus what’s myth can save you from costly mistakes and unnecessary stress. Let’s clear up the most common misconceptions that trip up people who are new to cryptocurrency.

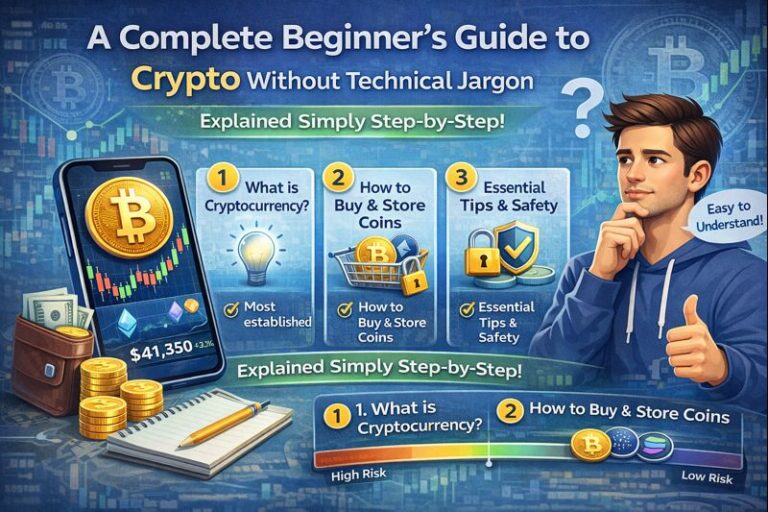

Myth: You Need to Buy a Whole Bitcoin

This is probably the most common and damaging myth for beginners. Many people see that Bitcoin costs tens of thousands of dollars and think they can’t afford to invest in it. They assume you need to buy at least one full Bitcoin, which seems impossibly expensive for most regular people.

The truth is you can buy tiny fractions of Bitcoin. Bitcoin is divisible down to eight decimal places. The smallest unit is called a satoshi, which equals 0.00000001 Bitcoin. You can invest $10, $50, $100, or any amount you want, and you’ll receive the corresponding fraction of a Bitcoin.

If Bitcoin costs $50,000 and you invest $100, you’ll own 0.002 Bitcoin. That’s perfectly fine. You don’t need a whole coin any more than you need to buy an entire pizza when you just want a slice.

This myth keeps people out of crypto unnecessarily. Whether you own 0.002 Bitcoin or 2 Bitcoin, the percentage gains and losses are identical. If Bitcoin goes up 10%, your investment goes up 10% regardless of how much you own.

Myth: You’re Too Late to Make Money

Whenever crypto prices are high, people assume they’ve missed the opportunity. They think the gains have already happened and there’s no money left to be made. This myth has been circulating since Bitcoin was $100, then when it was $1,000, then at $10,000, and it persists today.

The reality is that nobody knows whether it’s too late or still early. Cryptocurrency is still a relatively new technology, and adoption is still growing. Many experts believe crypto is still in its early stages despite the gains already seen.

More importantly, thinking you’re too late often leads to two bad outcomes. Either you don’t invest at all and miss potential future gains, or you chase risky smaller cryptocurrencies hoping to find “the next Bitcoin” instead of investing in established coins with better track records.

Whether crypto continues growing significantly or not, making decisions based on the myth that you’ve missed out isn’t helpful. Evaluate crypto on its current merits and future potential, not on regret about the past.

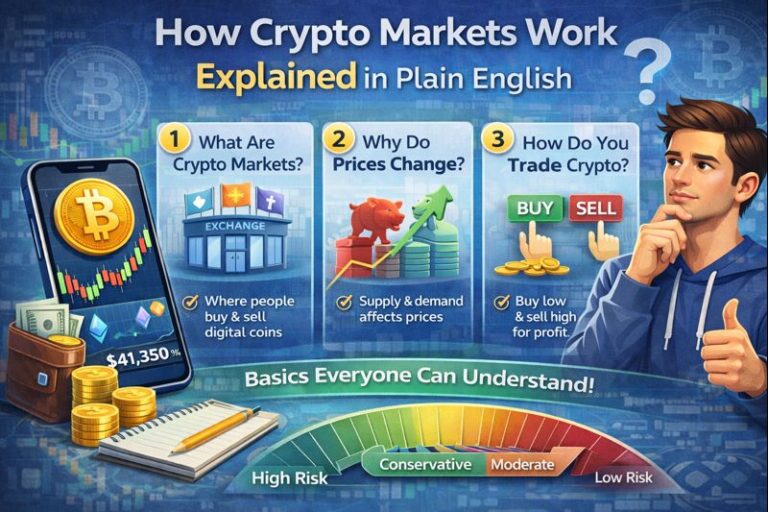

Myth: Crypto Is Only for Criminals

This persistent myth suggests that cryptocurrency’s main use is for illegal activities like buying drugs, laundering money, or paying ransoms. While it’s true that some criminals have used crypto, this characterization is wildly inaccurate and outdated.

The vast majority of cryptocurrency transactions are completely legal. People invest in it, businesses accept it as payment, and individuals use it to send money internationally or as a hedge against inflation. Major corporations, investment funds, and even some governments now hold cryptocurrency.

Furthermore, cryptocurrency is actually terrible for most criminal activities. Every transaction is recorded on a public ledger that anyone can see. While user identities aren’t automatically attached to transactions, law enforcement has become very good at tracing crypto transactions and identifying the people behind them. Cash is much more anonymous and harder to trace than most cryptocurrencies.

This myth persists partly because of early associations with illegal marketplaces and partly because people fear what they don’t understand. But dismissing crypto as a criminal tool ignores the legitimate uses that the overwhelming majority of users engage in.

Myth: Crypto Has No Real Value

Skeptics often claim that cryptocurrency has no intrinsic value because it’s not backed by a government or physical asset. They argue it’s worth nothing and the whole thing is essentially a collective delusion.

This misunderstands how value works in modern economies. Most things we consider valuable aren’t backed by physical assets either. The money in your bank account is mostly just numbers in a database. The vast majority of dollars exist only digitally, not as physical cash. Yet we all agree these digital dollars have value.

Cryptocurrency has value for the same reason any money has value: because people agree it does and are willing to exchange goods, services, or other currencies for it. Bitcoin has value because it’s scarce, transferable, divisible, and people want it. That’s how value works for anything, from gold to dollars to baseball cards.

Beyond that, different cryptocurrencies have different value propositions. Bitcoin offers a limited supply and decentralized transfer of value. Ethereum enables smart contracts and decentralized applications. Other cryptocurrencies solve specific problems or offer particular features. Whether you personally see value in these features doesn’t change the fact that millions of people do.

Myth: Crypto Is a Get Rich Quick Scheme

Many people enter crypto expecting to get rich quickly with minimal effort or knowledge. They see stories of people who made fortunes and assume the same will happen to them automatically. This myth is dangerous because it leads to poor decisions and unrealistic expectations.

The truth is that while some people have made significant money with cryptocurrency, many others have lost money. The people who made fortunes often took substantial risks, got lucky with timing, or held through massive volatility for years. For every story of someone who got rich, there are countless untold stories of people who lost money or gave up.

Treating crypto as a get rich quick scheme usually results in chasing pumps, buying at peaks, panic selling during dips, and falling for scams promising guaranteed returns. Real wealth building in crypto, like in any investment, typically requires patience, discipline, and a long term perspective.

If you approach crypto expecting quick riches, you’re likely to be disappointed and potentially lose money. If you approach it as a legitimate but volatile investment that might appreciate over years, you’ll make better decisions and have more realistic expectations.

Myth: All Cryptocurrencies Are Basically the Same

Beginners often think all cryptocurrencies work the same way and serve the same purpose. They assume the only difference is the name and price, so they might as well buy whichever is cheapest or most hyped.

In reality, cryptocurrencies are extremely diverse. Bitcoin focuses on being a store of value and medium of exchange. Ethereum is a platform for running decentralized applications. Some cryptocurrencies prioritize privacy, others focus on fast payments, and some aim to solve specific industry problems.

The underlying technology, governance, supply limits, use cases, and development teams all vary dramatically between different cryptocurrencies. Buying random cryptocurrencies without understanding these differences is like buying random stocks without knowing what the companies actually do.

This is why research matters so much. You need to understand what you’re buying and why it might have value. The fact that something is a cryptocurrency doesn’t automatically make it a good investment or equivalent to other cryptocurrencies.

Myth: If You Lose Your Password, Customer Service Can Help

This myth comes from people’s experience with traditional accounts like email or banking, where you can usually recover access if you forget your password. With cryptocurrency held in personal wallets, that’s often not how it works.

If you lose access to a cryptocurrency wallet, particularly the recovery phrase or private keys, your crypto can be permanently lost. There’s no customer service to call, no password reset option, and no way to prove ownership and get your funds back. This is because cryptocurrency is designed to be truly yours alone, with no central authority that can override your control.

Now, if your crypto is held on an exchange like Coinbase or Kraken, you can recover your account through their normal password reset procedures because they control the crypto on your behalf. But with personal wallets, you are solely responsible for security and access.

This isn’t meant to scare you away from personal wallets, but to emphasize the critical importance of safely storing your recovery phrases and passwords. Many people have lost fortunes because they didn’t take this responsibility seriously enough.

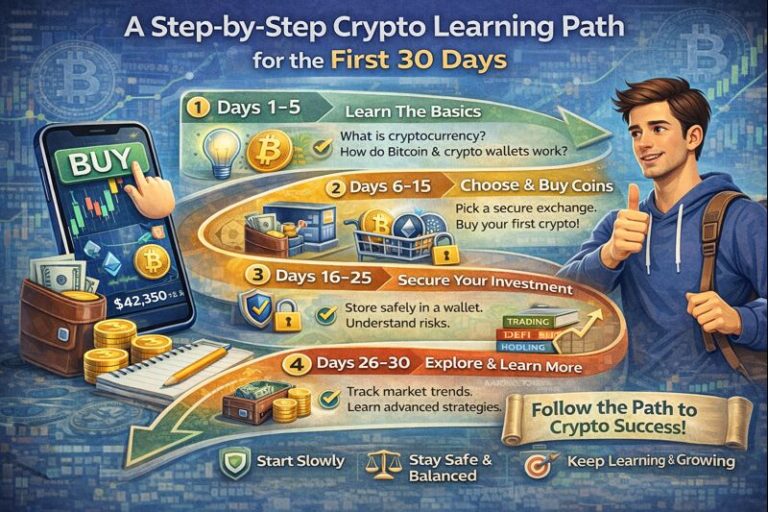

Myth: Crypto Investing Requires Constant Trading

Many beginners think successful crypto investing means constantly buying and selling, watching charts all day, and trying to time every market movement. They see traders posting about their moves on social media and assume that’s what crypto investing looks like.

The reality is that constant trading usually loses money for most people, especially beginners. Transaction fees add up, taxes on each sale become complicated, and timing the market consistently is nearly impossible even for professionals.

Most successful long term crypto investors use a simple strategy: buy quality cryptocurrencies regularly, hold them for years, and ignore short term price movements. This boring approach typically outperforms active trading for the average person.

You can be a successful crypto investor by making a purchase once a week or once a month and then not thinking about it until your next scheduled purchase. In fact, this approach often works better than obsessively watching prices and making frequent trades.

Myth: Crypto Is Too Complicated for Regular People

The technical aspects of cryptocurrency can seem intimidating. Words like blockchain, cryptographic hashing, and distributed ledgers sound complex and mathematical. Many people assume they need computer science knowledge to invest in crypto.

The truth is you don’t need to understand the technical details any more than you need to understand how the internet works to use email or how engines work to drive a car. You can successfully invest in cryptocurrency with just a basic understanding of what it is and how to use an exchange.

Exchanges have become increasingly user friendly, with interfaces as simple as any banking app. Buying crypto is now as straightforward as buying anything else online. You don’t need technical knowledge; you need basic financial literacy and common sense.

Of course, learning more about the technology helps you make better investment decisions and feel more confident. But don’t let the perception of complexity prevent you from getting started. Millions of non technical people successfully buy and hold cryptocurrency.

Myth: You Must Store Crypto in a Special Hardware Wallet Immediately

A common piece of advice that scares beginners is that they must immediately buy a hardware wallet and move their crypto off exchanges, or it’s not safe. While hardware wallets are indeed more secure for large holdings, this advice is overkill for beginners with small investments.

For someone just starting with $100 or $500 invested, keeping crypto on a reputable exchange is perfectly reasonable. The convenience and simplicity outweigh the small additional security risk. Exchanges have insurance, security measures, and customer support that beginners benefit from.

Hardware wallets make sense once you have a substantial amount invested, perhaps several thousand dollars or more. At that point, the added security justifies the cost and complexity of managing your own wallet.

Starting simple and graduating to more advanced security measures as your investment grows is a sensible approach. Don’t let hardware wallet advice prevent you from getting started or make you feel like you’re doing something wrong by using an exchange.

The Bottom Line

The crypto space is full of myths that confuse and mislead beginners. You don’t need to buy whole coins, you’re not necessarily too late, crypto isn’t just for criminals, and it’s not too complicated for regular people. Most successful crypto investors buy and hold rather than constantly trade, and you can safely start with crypto held on exchanges before worrying about personal wallets.

Understanding what’s true versus what’s myth helps you make better decisions and avoid common beginner mistakes. Approach crypto with realistic expectations, do basic research, and don’t let misconceptions prevent you from learning and potentially benefiting from this technology.

The key is thinking critically about information you encounter, especially advice that seems designed to make you feel fear, urgency, or inadequacy. Take your time, learn gradually, and make decisions based on facts rather than myths.