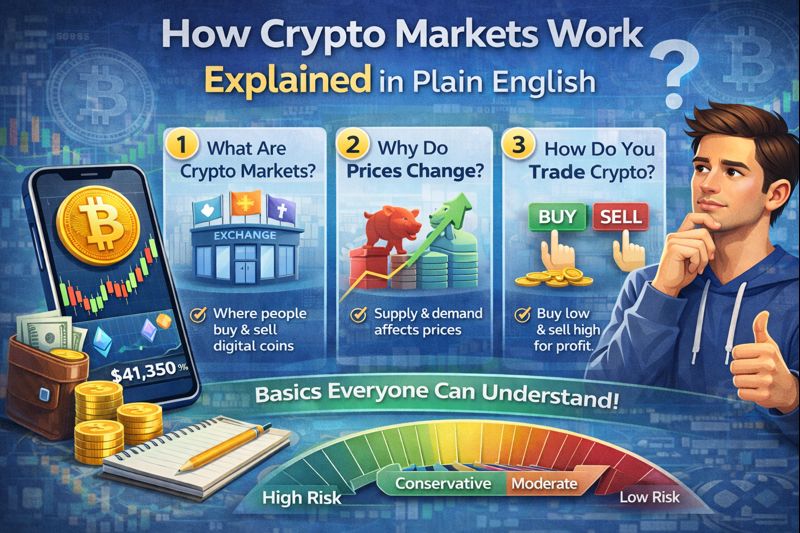

How Crypto Markets Work Explained in Plain English?

You’ve probably looked at a cryptocurrency price chart and wondered what makes those numbers move up and down so dramatically. One day Bitcoin is up 10%, the next day it’s down 15%. Ethereum shoots up 30% in a week, then loses it all the following week. What’s actually happening behind these wild price swings?

Understanding how crypto markets work doesn’t require a finance degree or deep technical knowledge. The basic principles are actually pretty straightforward once someone explains them in regular language without all the industry jargon.

Think of crypto markets like any other marketplace, whether it’s a farmers market, a stock exchange, or even a busy restaurant. The same fundamental forces of supply, demand, and human psychology drive prices. The difference with crypto is that these forces play out much more dramatically and quickly than in traditional markets.

The Basic Principle: Supply and Demand

At the heart of every market, including crypto, is the simple relationship between supply and demand. If more people want to buy something than sell it, the price goes up. If more people want to sell than buy, the price goes down. That’s it. Everything else is just details about what influences these buying and selling decisions.

Imagine a concert where only 1,000 tickets are available but 5,000 people want to go. Those tickets will become expensive because demand outweighs supply. Now imagine the opposite: a concert with 5,000 tickets available but only 1,000 people interested. Those tickets will be cheap or even unsold.

Cryptocurrency works the same way. When lots of people want to buy Bitcoin and few people want to sell, Bitcoin’s price rises. When lots of people want to sell and few want to buy, the price falls. The price you see on any exchange is simply the most recent price at which a buyer and seller agreed to make a trade.

Many cryptocurrencies have limited supplies. Bitcoin, for example, will only ever have 21 million coins in existence. This cap creates scarcity similar to gold or other precious metals. As demand increases for something with limited supply, prices naturally rise.

How Exchanges Connect Buyers and Sellers

Cryptocurrency exchanges are where all the buying and selling happens. Think of them as digital marketplaces that match people who want to buy crypto with people who want to sell it.

When you place an order to buy Bitcoin at $50,000, you’re not buying it from the exchange itself. The exchange is simply connecting you with someone who wants to sell their Bitcoin for $50,000. The exchange takes a small fee for providing this service, but it’s basically just a middleman bringing buyers and sellers together.

There are two main types of orders you can place. A market order means you want to buy or sell right now at whatever the current price is. If Bitcoin is trading at $50,000 and you place a market order to buy, you’ll get it at $50,000 or very close to it.

A limit order means you set a specific price you’re willing to pay. You might say you want to buy Bitcoin but only if it drops to $48,000. Your order sits there waiting until someone is willing to sell at that price. If the price never reaches $48,000, your order never gets filled.

The exchange maintains an order book, which is just a list of all the buy orders and sell orders waiting to be matched. When buy and sell orders meet at the same price, a trade happens, and that becomes the new market price.

Why Crypto Markets Are So Volatile

If you’ve watched crypto prices for even a day, you’ve noticed they move much more dramatically than stocks or other traditional investments. A 5% move in a single day would be huge for the stock market. In crypto, 5% moves happen constantly, and 20% or 30% swings aren’t uncommon.

Several factors create this extreme volatility. First, crypto markets are relatively small compared to traditional financial markets. The entire cryptocurrency market is worth around a few trillion dollars. That sounds huge, but it’s actually tiny compared to stock markets, real estate, or bond markets. In smaller markets, it takes less money moving in or out to create big price changes.

Second, crypto markets never sleep. Stock markets are open for specific hours on business days. Crypto markets run 24 hours a day, seven days a week, 365 days a year. This means price action and volatility can happen at any time, even when you’re sleeping.

Third, cryptocurrency is still relatively new and uncertain. People aren’t entirely sure what it’s worth or what its future looks like. This uncertainty makes people more likely to change their minds quickly, creating rapid buying and selling.

Finally, crypto attracts a lot of speculative traders. These are people trying to profit from short term price movements rather than holding long term. When many traders are trying to guess which way prices will move next and reacting quickly, it creates a lot of volatility.

What Actually Moves Crypto Prices

Now that you understand the mechanics of how markets work, let’s talk about what actually causes people to buy or sell, which in turn moves prices.

News and announcements have enormous impact on crypto markets. When a major company announces it will accept Bitcoin, prices usually jump. When a government announces new regulations, prices might drop if the regulations seem restrictive or rise if they seem favorable. When a security breach happens at an exchange, prices often fall as people worry about safety.

The influence of major investors and institutions matters significantly. When a well known company or wealthy individual announces they’re buying cryptocurrency, many others follow, pushing prices up. These large players can move markets simply by announcing their intentions.

Social media and online communities play a bigger role in crypto than in traditional markets. A tweet from a influential figure can send prices soaring or crashing. Reddit forums, Telegram groups, and other online communities discuss and sometimes coordinate buying, which can create short term price movements.

Technology updates and developments in the crypto space affect prices. When a cryptocurrency successfully implements a major upgrade or solves a technical problem, its price often rises. When problems or delays occur, prices may fall.

Broader economic conditions influence crypto markets too. When traditional markets are uncertain and inflation is high, some people buy cryptocurrency as an alternative investment, pushing prices up. During economic booms when stocks are doing well, money might flow out of crypto into other investments.

Market Sentiment and Psychology

One of the most powerful forces in crypto markets is human emotion and group psychology. Markets aren’t perfectly rational. They’re driven by real people making decisions based on hope, fear, greed, and everything in between.

During bull markets, when prices are rising, optimism spreads. More people want to buy because they see prices going up and don’t want to miss out. This buying pushes prices even higher, attracting more buyers, creating a cycle that can drive prices to levels that don’t make rational sense. This is how market bubbles form.

Eventually, something triggers doubt. Maybe prices have risen too far too fast, or bad news emerges. People start selling to lock in profits. As prices begin falling, fear spreads. More people sell, pushing prices lower, which scares more people into selling. This creates the opposite cycle, driving prices down rapidly.

Fear of missing out, often called FOMO, drives many buying decisions. When people see others making money and prices rising, they feel compelled to jump in even at high prices. This emotional buying often leads to buying at peaks right before prices fall.

Fear, uncertainty, and doubt, sometimes called FUD, drives selling. Negative news, even if not entirely accurate or significant, can trigger waves of panic selling as people worry about losing their money.

Trading Volume and Liquidity

Volume refers to how much cryptocurrency is being bought and sold over a given period. High volume means lots of trading activity. Low volume means relatively little buying and selling.

Volume matters because it affects how easily you can buy or sell. In high volume markets with lots of activity, you can buy or sell large amounts without dramatically affecting the price. In low volume markets, even modest sized orders can cause significant price movements.

Think of it like trying to sell a house. In a neighborhood where houses sell frequently, you can sell at the market price fairly easily. In a neighborhood where houses rarely sell, you might have to lower your price significantly to find a buyer. That’s essentially the difference between high and low liquidity.

Major cryptocurrencies like Bitcoin and Ethereum have high volume and good liquidity. You can buy or sell large amounts relatively easily. Smaller, less popular cryptocurrencies often have low volume and poor liquidity, making them riskier and harder to trade.

Market Cycles and Patterns

Crypto markets tend to move in cycles, alternating between periods of growth and decline. These cycles can last months or even years.

Bull markets are extended periods when prices are generally rising and optimism is high. During bull markets, even minor pullbacks quickly recover, and most cryptocurrencies increase in value. These periods attract new investors and generate lots of media attention.

Bear markets are extended periods when prices are generally falling and pessimism dominates. During bear markets, rallies are brief and quickly reverse. Many people lose interest in crypto, media coverage becomes negative or disappears, and some investors leave the market entirely.

Between these extremes are periods of consolidation where prices move sideways without clear direction. These periods can feel boring but often represent markets digesting previous moves and preparing for the next major trend.

Understanding that these cycles are normal can help you avoid emotional reactions. When you know that bear markets eventually end and bull markets eventually correct, you’re less likely to panic sell at bottoms or buy excessively at tops.

The Role of Market Makers and Whales

Not everyone in crypto markets is an individual investor like you. There are also major players whose actions significantly impact prices.

Market makers are firms or individuals who continuously offer to buy and sell cryptocurrencies. They profit from the small difference between buying and selling prices. Their constant activity provides liquidity and helps prices stay relatively stable. Without market makers, prices would jump around even more erratically.

Whales are individuals or organizations holding massive amounts of cryptocurrency. When a whale decides to buy or sell a large position, it can move the entire market. A single large sell order can temporarily crash prices, while a large buy order can spike them.

These major players have advantages over regular investors. They have more information, better tools, and enough capital to influence prices. This doesn’t mean regular investors can’t succeed, but it does mean you’re competing in a market where not everyone has the same advantages.

The Bottom Line

Crypto markets work on the same basic principle as any other market: supply and demand. Buyers and sellers meet on exchanges, and their interactions determine prices. The unique characteristics of crypto, including limited supply, 24/7 trading, relative newness, and heavy speculation, create the extreme volatility you see.

Prices move based on news, major investor actions, technology developments, economic conditions, and perhaps most importantly, human psychology and emotion. Markets cycle between optimism and pessimism, creating bull and bear markets that can last for extended periods.

Understanding these mechanics won’t let you predict exactly where prices will go, but it will help you make sense of what you see happening. You’ll understand why prices jump on certain news, why volatility is normal, and why emotional reactions often lead to poor investment decisions.

The crypto market can seem chaotic and random, but there are underlying forces and patterns at work. Recognizing these patterns and understanding the mechanics gives you a significant advantage as you navigate this exciting but challenging investment landscape.